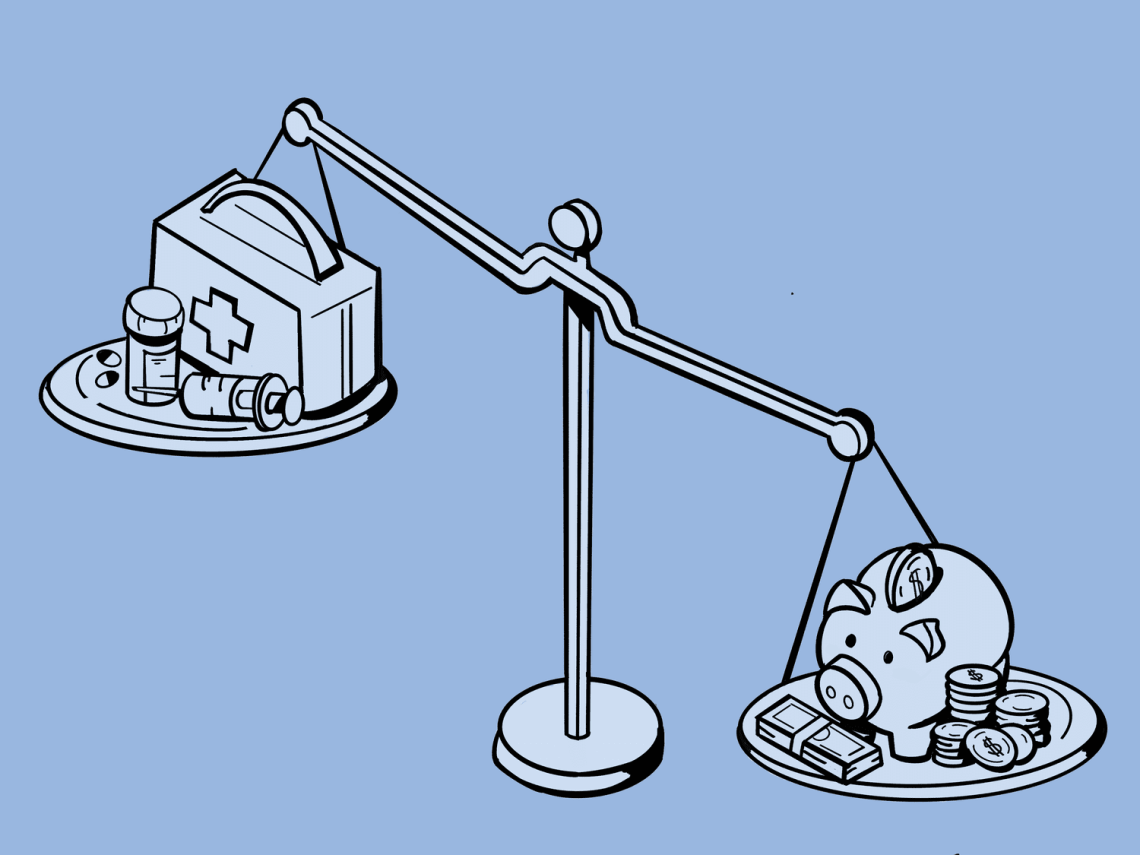

In today’s society, it has become impossible to ignore the magnitude of the escalating medical expenses and its effect on premiums. Private health insurance premiums are increasing due to higher healthcare costs and rising claims, creating a financial burden for both individuals and businesses.

Analyzing the Surge in Private Health Insurance Rates

It’s no secret that we’ve been witnessing a surge in private health insurance rates recently. Rising private health insurance rates are, in fact, linked to the continuously increasing costs of healthcare services. For many policyholders, this increased financial burden is alarming and impactful. When analyzing the changes in health insurance premiums, it’s vital to understand the role that escalating health costs play in this significant surge.

Key Takeaways: Healthcare Cost Impact on Insurance Premiums

Several aspects come into play when considering the healthcare cost impact on insurance premiums. The direct correlation between the increasing costs for medical services and the rise in health insurance rates can’t be overlooked. For every dollar spent on healthcare services, there’s a corresponding increase in insurance premiums, negatively impacting the affordability of private health insurance for many consumers.

Higher Healthcare Costs and Insurance: An Interlinked Phenomena

The dependency between higher healthcare costs and insurance is more than just a simple cause-and-effect relationship. As medical expenses continue to escalate, the burden of these costs is transferred to policyholders in the form of increased premiums, making private health insurance less affordable.

Private Health Coverage Expenses Surge: Reasons and Effects

The reasons for the private health coverage expenses surge are multifaceted. Factors like advanced technology, expensive procedures, and increasing demand for healthcare services all contribute to these mounting costs. This surge significantly affects the affordability of insurance, leading to a drop in the number of insured individuals, and thus, intensifying the health crisis.

Claims Escalation and How it Influences Insurance Costs

With healthcare costs on the rise, there’s been an increase in the amount of claims that insurance providers are obligated to pay. This claims escalation and insurance costs are unavoidably intertwined. The more the insured have to use their insurance due to expensive medical procedures, the more the insurers have to pay out, which subsequently leads to increased premiums.

Impact of Escalating Health Claims on Premiums

There’s a direct relationship between escalating health claims and their impact on premiums. Escalating health claims impact premiums by putting upward pressure on insurance rates. The more often policyholders must use their coverage due to the increased cost of healthcare, the more the insurers must pay out, leading to higher premiums to balance out those costs.

The Correlation between Increasing Private Health Policy Costs and Rising Premiums

The private health policy costs rising is a real concern for many individuals. With medical costs escalating, insurers are forced to raise their policy costs to adequately cover these increasing expenses. Unfortunately, this invariably leads to increased insurance premiums, thus creating a growing financial burden for policyholders.

Rising Healthcare Costs and Its Direct Influence on Insurance

The continuous rising healthcare costs impact on insurance premiums can be directly traced back to rising medical expenses. Every dollar increase in healthcare costs often leads to a proportional increase in health insurance premiums. Thus, a higher cost of healthcare is essentially passing the expense to the insurance holders in the form of increased premiums.

Premiums Spike: How Increased Medical Expenses Are To Blame

Understanding that the premiums spike due to healthcare expenses is crucial in comprehending the overall picture of our healthcare system. Increased medical expenses are one of the most significant factors causing premiums to spike, often making private health coverage unaffordable for many Americans.

Higher Claims Triggering a Significant Increase in Premiums

Understandably, higher claims leading to premium increase adds even more financial burden on policyholders. As healthcare service costs become exorbitant, higher claims are inevitable leading to an exponential rise in policy premiums.

Understanding the Impact of Medical Costs on Insurance Premiums

An in-depth understanding of the impact of rising medical costs on premiums is essential to identifying ways to mitigate this issue. Insurance providers must be able to balance their coverage offerings with costs to make insurance affordable for policyholders.

The Growing Expenses in Private Health Coverage: A Major Concern

The expense for private health coverage has skyrocketed, breaking records every year. The rising healthcare costs impact on insurance can be clearly seen here. This growing trend is a significant concern and poses a threat to the affordability of health coverage in the United States.

How Health Insurance Rates Are Being Affected by Growing Claims

Health insurance premiums and claims correlation is an undeniable truth. As claims rise with increased healthcare costs, insurance premiums increase. This correlation creates a significant problem in the affordability of health coverage, leaving many uninsured or underinsured.

Escalation in Medical Expenses and Its Effect on Premiums

Finally, it’s essential to address how escalation in medical expenses affecting premiums. When healthcare costs escalate, the effect is an upward adjustment of insurance premiums to balance out the increased expenditure. The health insurance industry is compelled to increase premiums due to this unprecedented rise in healthcare costs, making private health insurance less affordable for many. The result is a vicious cycle of increasing healthcare costs and premium rates.

In conclusion, the rising cost of healthcare and the consequent escalation of health insurance premiums are issues of significant concern. Breaking this cycle will require a comprehensive approach that might include regulation, increased competition in the healthcare industry, and other innovative solutions. Until then, the tension between escalating healthcare costs and the affordability of insurance coverage persists making it imperative for both policymakers and insurance companies to find solutions to this ever-growing problem.